La distribution des actions par Kering est effective - Page 2

Cours temps réel: 15,57 0,39%| Cours | Graphes | News | Analyses et conseils | Historiques | Vie du titre | Forum |

PUMA ET J.COLE ANNONCENT UN PARTENARIAT OFFICIEL

LE SPOT TV SERA DIFFUSÉ PENDANT LE MATCH DES ÉTOILES DE LA NBA EN 2020

Communiqué du 13 février 2020

https://about.puma.com/en/newsroom/corporate-news/2020/2020-02-13-jcole

Aujourd'hui, la société sportive mondiale PUMA a officiellement annoncé un partenariat de plusieurs années avec l'artiste J.Cole, lauréat d'un Grammy Award, avec un court métrage et une publicité télévisée qui ont été conçus et co-réalisés par Cole lui-même. Le thème du spot parle de ne jamais abandonner son rêve, malgré les obstacles rencontrés ou le temps passé. Le spot a été produit conjointement par PUMA et Dreamville et sera diffusé dimanche lors du match des étoiles de la NBA sur la TNT.

J Cole Sky Dreamer

PUMA a misé sur Cole en raison de ses liens avec le basket, la mode et la culture musicale. "Notre partenariat avec Cole est profondément enraciné", a déclaré Adam Petrick, directeur mondial de la marque et du marketing chez PUMA. "Cole est impliqué dans la création de produits, les campagnes de marketing et l'orientation culturelle. Il sera un acteur clé dans de nombreuses activités que nous menons chez PUMA à l'avenir et nous sommes ravis de travailler avec lui non seulement au niveau des produits, mais aussi et surtout en tant que l'un de nos athlètes. Cole se situe à l'intersection de la musique et du sport et représente tout ce que PUMA représente en tant que marque".

|

Répondre

|

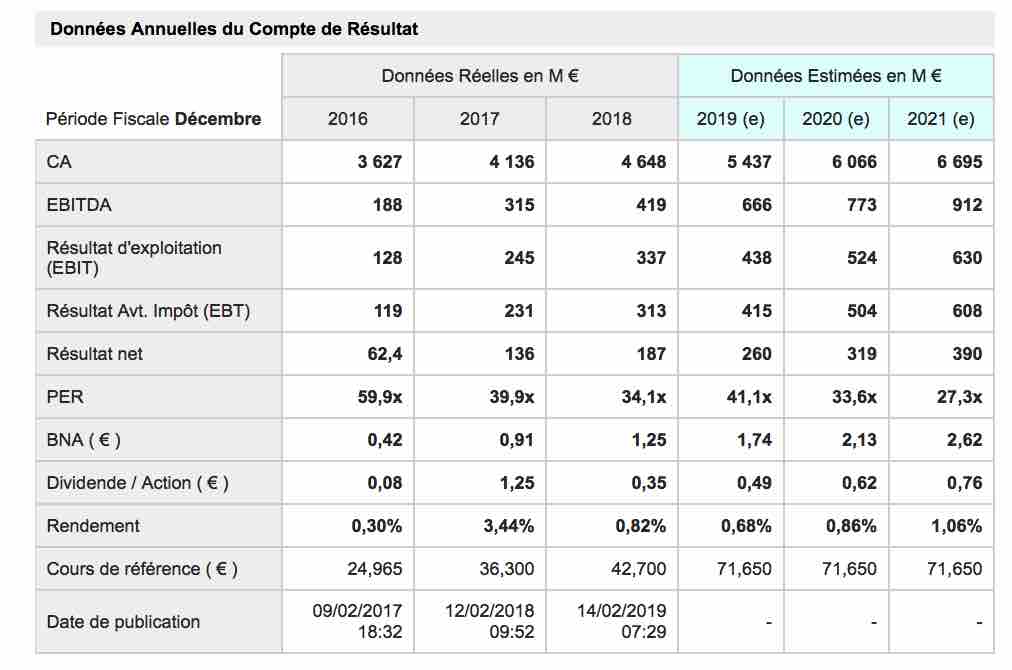

Les Prévisions : entre 2018 et 2021, le CA annuel devrait augmenter de 50% et le résultat net devrait doubler.

(voir fondamentaux sur la fiche du site ZB)

.

|

Répondre

|

Agenda Financier 2020 de PUMA SE

• 19-FEB-2020 : FULL YEAR FINANCIAL RESULTS 2019

10 am Quarterly Statement & 3 pm Analyst Webcast and Call

• 30-APR-2020 : FIRST QUARTER RESULTS 2020

8 am Quarterly Statement & 3 pm Analyst Call

• 07-MAY-2020 : ANNUAL GENERAL MEETING 2020

Herzogenaurach, Germany

• 29-JUL-2020 : SECOND QUARTER RESULTS

8 am Quarterly Statement & 3 pm Analyst Call

• 28-OCT-2020 : THIRD QUARTER RESULTS

8 am Quarterly Statement & 3 pm Analyst Call

______________________________________________________

|

Répondre

|

BOSTON, MASSACHUSETTS; JANUARY 22ND, 2020

PUMA SIGNS CURRENT LONG JUMP WORLD CHAMPION

https://about.puma.com/en/newsroom/corporate-news/2020/2020-01-22-puma-tajay-gayle

------------------------------------------------------------------------------------------------------------------------------------------------

Global sports brand PUMA has signed current long jump World Champion Tajay Gayle. He recently competed at the 2019 Doha World Athletics Championships where he took home the gold medal for his 8.69m mark, making him the first Jamaican athlete to win first place in the long jump at a World Championship.

“Tajay is one of the best young talents out there”, said Pascal Rolling, Head of Running Sports Marketing for PUMA. “He recently accomplished a great feat during the recent World Champs, and we are sure he will perform great during 2020. He shares all of our brand values, making him the perfect new addition to our roster of Track and Field athletes.”

“I’m so honored and happy to join the PUMA family, just like Usain Bolt,” said Tajay. “I’ve been working hard since I was a kid to accomplish my objectives, and this is definitedly one of them. I can’t explain how exciting this is for me. This new stage will allow me to prove everyone that I’m the best in the game.”

Tajay comes from a small community in Eastern St. Andrew, Jamaica, he started his carrer trying out different dicisplines, including decathlon, until he found his love for long jump. This happened by chance during one of his training sessions. That day the mat of the high jump was wet, making it hard for him to do a safe landing. His coach made him do long jump practice instead. After this blessing in disguise, he’s been unstoppable.

|

Répondre

|

BOSTON, MASSACHUSETTS; JANUARY 17TH, 2020

INTENSIFY YOUR TRAINING WITH PUMA´S NEW LQD CELL HYDRA

Global sports brand PUMA will intensify any workout with its new LQD CELL Hydra, which offers stable cushioning thanks to its full-length LQD CELL technology midsole.

https://about.puma.com/en/newsroom/brand-and-product-news/2020/2020-01-17-lqd-cell-hydra

|

Répondre

|

HERZOGENAURACH, GERMANY - JANUARY 16, 2020

BE THE SPARK - PUMA UNLEASH THE SPARK PACK

https://about.puma.com/en/newsroom/brand-and-product-news/2020/2020-01-15-puma-spark-pack

--------------------------------------------------------------------------------------------------------------------------------

Sports company PUMA unveil the electrifying SPARK PACK. Featuring the PUMA FUTURE 5.1 in striking Ultra Yellow – PUMA Black and the PUMA ONE 20.1 in the Ultra Yellow – PUMA Black – Orange Alert color way.

The SPARK PACK is for the players who SPARK their team – the game changers. Players who show unique technique or dynamic and incisive movement igniting creativity on the pitch. They are the new legends that energize the fans and strike fear into the hearts of their opponents.

The PUMA FUTURE 5.1 is inspired by the game’s most dynamic players. Incorporating adaptable NETFIT support into a fully knitted upper, the FUTURE reacts with the movement of the foot, enhancing both fit and stability, placing agility at the centre of its design. The PUMA FUTURE 5.1 SPARK colorway will be worn by Antoine Griezmann, Luis Suárez, Dzsenifer Marozsán and Marco Reus.

Crafted for precise touch, deadly accuracy and instinctual finishing, the PUMA ONE 20.1 combines the lightweight stabilizing properties of SPRINTWEB with premium K-Leather to create the complete balance of speed, touch and support. The PUMA ONE 20.1 SPARK colorway will be worn by Sergio Agüero, Nikita Parris, Axel Witsel and Eugénie Le Sommer.

Are you ready to BE THE SPARK? The SPARK PACK will be available on PUMA.com, at PUMA stores and at leading football retailers on January 16, 2020.

When asked about the SPARK PACK, Pep Guardiola said: “It all starts with a SPARK, that is how players become champions. They are the players that can change a game in an instant, they are the players who are redefining the game. The PUMA SPARK PACK is for the players who want to BE THE SPARK”.

.

|

Répondre

|

HERZOGENAURACH, GERMANY, 14 JANUARY, 2020

PUMA SIGNS LONG-TERM PARTNERSHIP WITH PSV EINDHOVEN

https://about.puma.com/en/newsroom/corporate-news/2020/2020-01-14-pumaxpsv

-------------------------------------------------------------------------------------

Sports company PUMA has entered into a new long-term partnership with PSV Eindhoven, one of the Netherlands most successful football clubs. Under the terms of the deal, PUMA will become the official kit supplier of the club, starting in July 2020.

PSV Eindhoven have won twenty-four league titles and nine domestic cups having also achieved great success in Europe winning both the European Cup and the UEFA Cup.

“PSV Eindhoven is one of the most proud and prestigious clubs in Europe, with an incredible football history. We are truly excited to partner with such an illustrious, well-supported club as they strive for continuous success on the pitch”, said Johan Adamsson, Director of Sports Marketing & Sports Licensing at PUMA. “We look forward to welcoming PSV Eindhoven into the PUMA family and supporting them in achieving their ambitions”.

PUMA x PSV

The PUMA and PSV Eindhoven partnership builds on the shared values of innovation and cooperation, evident by the club motto ‘Unity Is Strength'. The club is deeply connected to Eindhoven, referred to as ‘The City of Light’, a city vibrant with culture, collaboration and global influence. Both PUMA and PSV Eindhoven’s ambitions are strongly aligned as they look to push boundaries on and off the pitch, connecting with the city and the fans in new and exciting ways.

PSV Commercial Director Frans Janssen said: “PUMA and PSV share the will to be better every day, that ambition is the foundation of this partnership. Their motto ‘Forever Faster’ is something that we recognize and embrace. We are very proud to team up with a global brand that gives us the opportunity to stay unique. Quality, comfort and authenticity are our main wishes regarding sportswear. These are all in the PUMA DNA. PSV is very honored to be welcomed into the PUMA family, joining great clubs such as Manchester City, AC Milan, BVB Dortmund and Valencia.”

|

Répondre

|

Nouvel excès de fièvre haussière sur 79 euros dans l'attente de la publication annuelle 2019.

Agenda financier 2020 :

• 19-FEB-2020 : FULL YEAR FINANCIAL RESULTS 2019 (8 am Quarterly Statement & 3 pm Analyst Call)

• 30-APR-2020 : FIRST QUARTER RESULTS 2020 (8 am Quarterly Statement & 3 pm Analyst Call)

• 29-JUL-2020 : SECOND QUARTER RESULTS ( 8 am Quarterly Statement & 3 pm Analyst Call)

• 28-OCT-2020 : THIRD QUARTER RESULTS (8 am Quarterly Statement & 3 pm Analyst Call)

Excellent parcours pour ceux qui n'ont pas succombé aux incitations de vendre à la distribution par Kering , on est actuellement avec une plus value de + 84.17%.

Graphiquement, pas gros de gros soucis si ce n'est un risque de repli pour fermer le petit gap haussier verts 69,85 euros. On devrait inscrire de nouveaux point prochainement, c'est bien partir pour en tout cas...

.

|

Répondre

|

Puma: Morgan Stanley relève son objectif de cours

Actualité publiée le 16/01/20

Morgan Stanley réaffirme son conseil 'surpondérer' sur Puma et relève son objectif de cours de 72 à 84 euros, soit un potentiel de hausse de 11%, à l'approche des résultats annuels 2019 du fournisseur allemand d'articles sportifs, prévus le 19 février.

'Nous pensons que la possibilité que certains des risques clés en 2020 se matérialisent a diminué, alors que les perspectives de Puma dans certaines zones géographiques clés demeurent très attractives', juge le broker en résumé de sa note de recherche.

|

Répondre

|

Puma : Jefferies initie une couverture à l'achat

02/12/2019

L'analyste Jefferies annonce ce jour initier une couverture du titre Puma avec une recommandation 'achat'

'Nos estimations concernant Puma sont 11% au-dessus du consensus en raison d'une vision plus optimiste de la Chine, appuyée par des données vérifiées, qui confirment le succès de la marque. En outre, nous pensons que l'expansion dans les secteurs de la vente en gros, du commerce de détail et en ligne devrait continuer à tirer la croissance des ventes du groupe', estime le broyer.

Jefferies fixe ainsi son objectif de cours à 83 dollars.

|

Répondre

|

Bonsoir gars d'ain,

Votre message mérite assurément une réponse complète et détaillée. Je n'ai pas ce soir le temps nécessaire pour cela.

Je m'en tiendrai pour l'instant à la forme de mon petit message dont vous n'aurez pas manqué de remarquer les marques de courtoisie à votre endroit allant jusqu'à la juste orthographe de votre pseudonyme, sans les jeux de mots que j'ai déjà pu remarquer par ailleurs. Je n'ai pas de mérite, cette façon de m'adresser à autrui est une tendance naturelle.

Je reviendrai, probablement à plusieurs reprises, compléter ma réponse sur cette file, au risque, vous m'en excuserez, de la "pourrir" !

Bien cordialement

|

Répondre

|

Comme d'autres, cette file est une file de suivi de valeur qui existe depuis plusieurs mois.

C'est pas la première qu'on a droit à ce genre de remarque désobligeante de la part de personnes lambda qui se contentent souvent de critiquer en ne postant jamais rien de concret.

C'est pas la peine pourrir la file pour ça.

Si vous aviez pris la peine de lire le contenu, vous aurez pu constater que, par ce biais, vous auriez eu une information assez complète des derniers évènements de PUMA avec une analyse graphique...

Mais manifestement, lire doit vous faire des migraines ophtalmiques...

Quand on vient à un endroit, on fait un minimum d'effort pour comprendre comment ça marche. Manifestement depuis que vous êtes inscrit, vous n'avez toujours pas fait cet effort... Ce serait donc bien de le faire.

Il y a tous les jours des files de suivi sur le forum qui sont alimentées...

: (

Message complété le 24/10/2019 18:25:35 par son auteur.

Ras le bol de vos messages cons ... c'est pas la première fois, et là ça suffit.

https://www.abcbourse.com/forums/msg656597_resultats-x-fab-pour-le-troisieme-trimestre-2018

|

Répondre

|

Bonjour gars d'ain,

Pourquoi réactualisez-vous cette file ?

Quel est le rapport entre son titre "La distribution des actions (Puma) par Kering est effective" qui date du 18 mai 2018 et votre intervention d'aujourd'hui ?

Cordialement

|

Répondre

|

Poursuite de latéralisation en repli sous 73,75 dans l'attente de publication des chiffres annuels 2019

On notera les supports sous le cours actuels : on teste actuellement le support de hausse en noir, on devrait l'enfoncer pour rejoindre les support en pointillés vert avant de se reprendre progressivement en vue de la publication annuelle.

Prochain évènement comptable

• 19-FEB-2020 : FULL YEAR FINANCIAL RESULTS 2019

.

|

Répondre

|

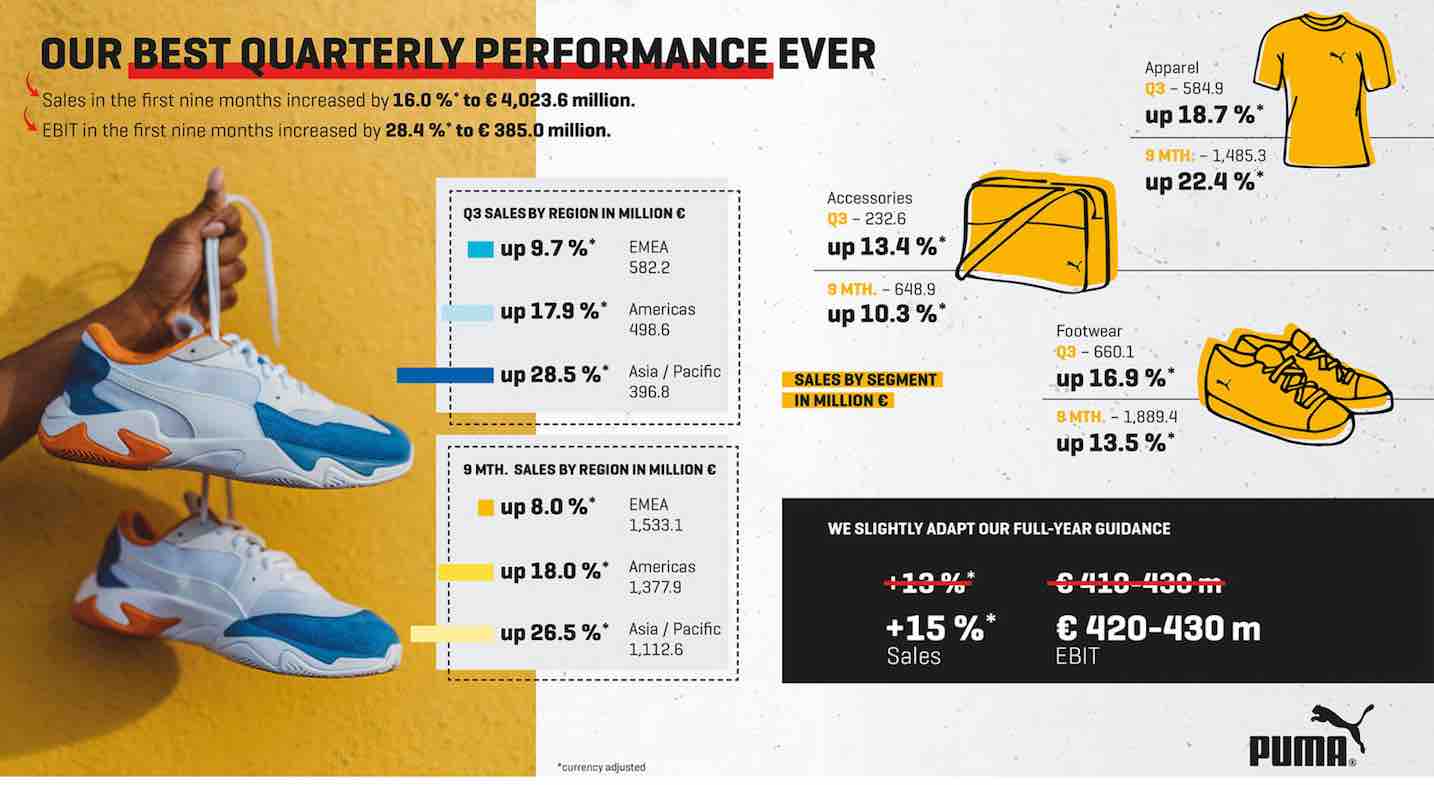

2019 THIRD-QUARTER FACTS

• Sales increase by 17.0% currency adjusted to € 1,478 million (+19.0% reported) with continued growth in all regions and product divisions

• Gross profit margin improves to 49.7%

• Operating expenses (OPEX) increase 18% (reported) due to higher sales related costs as well as higher marketing and retail investments

• Operating result (EBIT) up by 25% to € 162 million

• PUMA opens its first ever North American flagship store on Fifth Avenue in New York

• At the World Athletics Championships in Doha (Qatar), PUMA athlete Karsten Warholm defends his title over 400m hurdles; overall, the 12 PUMA-sponsored federations and 115 athletes competing in Doha ensured a high level of visibility for the brand

• PUMA signs the Morocco national football federation

• PUMA adds RJ Barrett from the New York Knicks and Kyle Kuzma from the Los Angeles Lakers to its growing roster of NBA players

2019 NINE-MONTHS FACTS

• Sales increase by 16.0% currency adjusted to € 4,024 million (+17.6% reported)

• Gross profit margin up by 60 basis points at 49.4%

• Operating expenses (OPEX) increase by 17% (reported) at a slightly lower rate than reported sales

• Operating result (EBIT) improves by 28% from € 300 million to € 385 million and EBIT-margin increases from 8.8% to 9.6%

• Net earnings increase by 39% from € 176 million last year to € 245 million and earnings per share increase from € 1.18 last year to € 1.64 correspondingly

Communiqué de presse | 24.10.2019

https://about.puma.com/en/newsroom/corporate-news/2019/2019-10-24-puma-q3-results

----------------------------------------------------------------------------------------------------------------------

BJØRN GULDEN, CHIEF EXECUTIVE OFFICER OF PUMA SE:

“The third quarter developed very positively for us and ended as the best quarter that PUMA has ever achieved - both in terms of revenue and EBIT. Double-digit sales growth in all divisions and almost in all regions (EMEA “only” 9.7%) underlines the favorable development of our brand. Especially positive for me was the 17% growth in Footwear, which shows the strong performance of the new styles, and EMEA’s growth of almost 10%, proving a good recovery in Europe. The fourth quarter will be the first quarter where the US tariffs on China will have an impact. Currently, without price increases, this is putting pressure on EBIT, at least in the short-term. Nevertheless, the good development in the third quarter and the outlook for the fourth quarter allows us to look at a sales growth of around 15% currency adjusted and an EBIT between € 420 million and € 430 million for the full year 2019.”

THIRD QUARTER 2019

PUMA's strong sales growth continued in the third quarter of 2019. Sales increased by 17.0% currency adjusted to € 1,477.6 million (+19.0% reported). The Asia/Pacific and Americas regions continued to contribute with double-digit increases, while growth in the EMEA region was at a high single-digit rate. Footwear, Apparel and Accessories all showed strong growth in the third quarter, improving by 16.9%, 18.7% and 13.4% respectively. Sportstyle, Motorsport, Golf and Running and Training were the categories with the highest growth rates.

The gross profit margin improved to 49.7% in the third quarter (last year: 49.6%). Small positive mix effects as well as slightly beneficial hedging led to margin improvements.

Operating expenses (OPEX) rose by 18.1% to € 578.5 million in the third quarter. The increase was mainly caused by higher sales-related variable costs, including logistics costs as well as higher marketing and retail investments, while the remaining OPEX only rose moderately.

The operating result (EBIT) increased by 24.8% from € 129.9 million last year to € 162.2 million due to a strong sales growth combined with an improved gross profit margin and operating leverage. This corresponds to an improvement of the EBIT-margin from 10.5% last year to 11.0% in the third quarter 2019.

Net earnings increased by 29.7% from € 77.5 million to € 100.5 million and earnings per share were up from € 0.52 in the third quarter last year to € 0.67 correspondingly.

NINE MONTHS 2019

Sales in the first nine months of 2019 rose by 16.0% currency adjusted to € 4,023.6 million (+17.6% reported). The strong sales development was largely driven by double-digit growth rates in Asia/Pacific, where China continued to be the main growth driver, and the Americas. EMEA grew at a high single-digit rate. The growth was driven by double-digit growth in all divisions: Footwear grew 13.5%, Apparel expanded by 22.4%, and Accessories increased by 10.3%.

Wholesale continued to drive growth with an increase of 14.5% currency adjusted, supported by a strong performance of our key accounts. PUMA's direct-to-consumer sales (owned and operated retail stores and eCommerce) increased by 21.3% currency adjusted to € 947.3 million. This was driven by like-for-like sales growth in our own stores, the expansion of our retail store network and a continued strong growth of our eCommerce business. Direct-to-consumer sales represented a share of 23.5% of total sales for the first nine months of 2019 (22.5% in the previous year).

The gross profit margin improved by 60 basis points from 48.8% to 49.4% in the first nine months of 2019. Positive impacts from regional, channel and product mix, lower discounts as well as slightly positive currency impacts led to margin improvements.

Operating expenses (OPEX) increased by 17.2% and amounted to € 1,620.7 million. The increase was driven by higher sales-related variable costs as well as continued investments in IT infrastructure, marketing and our own retail business.

The operating result (EBIT) grew by 28.4% from € 299.8 million last year to € 385.0 million in the first nine months of 2019 due to a strong sales growth combined with an increased gross profit margin and a slight operating leverage. This led to an improved EBIT-margin of 9.6% compared to 8.8% in the first nine months last year.

Net earnings rose by 39.0% to € 244.6 million (last year: € 176.0 million). This translates into earnings per share of € 1.64 compared to € 1.18 in the first nine months of 2018.

WORKING CAPITAL

Inventories were up by 28.4% at € 1,140.8 million. Earlier purchase of products to balance supplier capacities and secure product availability, more retail stores in operation and the general sales growth led to the increase. In the third quarter, the latest currency developments as well as an increased front-loading of product for the United States prior to tariff increases further added to the development. Trade receivables rose by 13.1% to € 794.8 million. On the liabilities side, trade payables were up by 23.0% to € 722.1 million. This resulted in an increase of working capital by 20.1% to € 915.7 million.

OUTLOOK 2019

The third quarter saw a continued strong increase in sales and profitability. Based on this and our expectations for the fourth quarter, we slightly adapt our guidance for the full year 2019. PUMA now expects that currency adjusted sales will increase around 15% (previous guidance: currency adjusted increase of around 13%). The gross profit margin is still anticipated to improve slightly (2018: 48.4%) and we continue to expect that operating expenses (OPEX) will increase at a slightly lower rate than sales. As a consequence, we expect the operating result (EBIT) to come in between € 420 million and € 430 million, despite the negative impact from new tariffs in the fourth quarter in the United States (previous guidance: between € 410 million and € 430 million). In line with the previous guidance, management expects that net earnings will improve significantly in 2019.

.

|

Répondre

|

PUMA : Financial CALENDAR

• 24-OCT-2019 : RESULTS THIRD QUARTER 2019

• 19-FEB-2020 : FULL YEAR FINANCIAL RESULTS 2019

|

Répondre

|

Taux négatifs.

Kering place 550 M€ d'obligations échangeables en actions Puma, plus que les 500 M€ prévus grâce à une forte demande. Kering possède encore 15,85% du capital de Puma.

Le rendement des convertibles à échéance (2022) est calculé à -2,78%. Elles permettent d'acquérir des actions Puma à 92,17 EUR, soit une prime de 35% sur les cours récents de la société allemande.

--------------------------------------------------------------------------------

ça laisse une belle marge de progression encore sur les niveaux actuels...

|

Répondre

|

Consolidation latérale en cours sous le dernier point haut à 71,25 euros.

Dans l'attente de Résultats pour le T3 /2019 le 24 octobre 2019, on devrait consolider latéralement que les niveaux actuel sous 72 euros et au dessus de 64 euros.

Très beau parcours boursier de Puma depuis que le titre a été offert aux actionnaires Kering...

Les indicateurs restent tendus et la demande de titre ne faiblit pas relayé par des conseils d'achat réguliers...

.

|

Répondre

|

HERZOGENAURACH, GERMANY - SEPTEMBER 6, 2019

ANTOINE GRIEZMANN CO-DESIGNS A FOOTBALL BOOT TO CELEBRATE TEN YEARS OF HIS PROFESSIONAL CAREER

---------------------------------------------------------------------------------

Ten Years. Ten Moments. One Boot.

Antoine Griezmann, one of the players of the moment, and PUMA sports brand, are celebrating the player’s 10 year anniversary of his professional debut. To honor this moment, Antoine has co-designed with the PUMA FAM the “Grizi 10-year edition” football boot.

Antoine Griezmann with his 10 Year Boots

Other than all the goals, awards and trophies, Griezmann’s motivation for playing has always been about enjoying the game to its fullest. Whether jumping in a car at the side of the stadium in 2010 to his recent ‘glitter’ celebration, Grizi lives up to his motto ‘Win with a Smile’.

The ‘Yellow-Alert’ boot FUTURE features a show-stopping Smiley graphic across the upper and his ‘Play with a smile’ motto on the outsole reflecting his positive outlook on the game.

Antoine Griezmann will be wearing a customized version of this special edition FUTURE, with the ten life-defining moments personally chosen by himself, told through the medium of emojis across the outsole: starting with his Real Sociedad debut (02.09.2009), beginning of the relation with his wife Erika (27.12.2011), signing with PUMA (01.07.2010), signing Atlético de Madrid (29.07.2014), His daughter Mia’s birth date (08.04.2016), his wedding with Erika (15.06.2017), Europe League final (16.05.2018), World cup final (15.07.2018), his son Amaro’s birth date (08.04.2019) and signing for FC Barcelona (12.07.2019).

ANTOINE'S LIFE-DEFINING MOMENTS

Antoine Griezmann joins PUMA family

Antoine Griezmann child milestone

Antoine Griezmann Marriage Milestone

Antoine Griezmann European Champion Milestone

Antoine Griezmann World Champion Milestone

Antoine Griezmann child milestone

Antoine Griezmann Barcelona Milestone

This is a very special boot for me. It tells my story, how I got to get where I am now. Choosing the ten highlights of my life and career has made me think about old times, what I have achieved so far and, I have realized I’m raring for what’s next.

ANTOINE GRIEZMANN

Antoine Griezmann will wear the Grizi 10-year edition against Albania on September 7th, Andorra on September 10th and, Valencia on September 14th.

The boot will is available in PUMA Stores, PUMA.com and leading football retailers.

|

Répondre

|

ERZOGENAURACH, GERMANY - SEPTEMBER 5, 2019

PUMA UNVEILS FIRST-EVER SMARTWATCH FOR LIFESTYLE ENTHUSIASTS

Lace up. Connect. Go. With the PUMA Smartwatch, powered with Wear OS by Google and Qualcomm® Snapdragon Wear™ 3100

PUMA and Fossil Group announce the PUMA Smartwatch—a first for the sports brand—powered with Wear OS by Google™ and equipped with the Qualcomm Snapdragon Wear 3100 platform.

PUMA Smartwatch in black

PUMA, the global sports brand, is excited to enter the smartwatch space with a wearable that is designed to help athletes train, stay motivated, track goals and connect with others while on the go. Bringing the best of sports lifestyle and technology together, the smartwatch is expertly designed to look and feel good, with a cut-out nylon and aluminum case that delivers an ultra lightweight fit. A textured silicone strap provides grip and breathability to minimize sweat while on the go. Available in three fashion-forward colorways, the PUMA Smartwatch easily transitions from the gym to the street, proving that the best workout doesn’t have to look boring.

PUMA Smartwatch in yellow

“Our customers consider technology a must for their lives—they’re looking for a smartwatch that will complement their active lifestyles,” says Adam Petrick, PUMA’s Global Director of Brand and Marketing. “We’re thrilled to introduce our first smartwatch, which embodies the PUMA brand DNA shown in activewear and footwear. The watch will truly allow users to lace up, connect, and go.”

PUMA Smartwatch in white

“The smartwatch segment continues to grow at a breathtaking pace and attract new, innovative brands to embrace this trend,” said Pankaj Kedia, senior director, product marketing, Qualcomm Atheros, Inc. “We are delighted to extend our collaboration with the Fossil Group by adding the Puma brand to the growing smartwatch portfolio. The Puma Smartwatch, which leverages the high performance and low power characteristics of the Snapdragon Wear 3100 platform and builds on Puma’s iconic heritage in lifestyle sports, will bring moments of delight to consumers around the world.”

Google Fit makes it simple to change and track activity goals, and notifies users on goal progress and completion. PUMA Smartwatch users can also choose from several interactive dial options, like the “Scorecard” dial which displays time, date and heart rate, and gives the ability for users to customize the information they can quickly view at a glance. Users can also upload photos from social media to display straight on their smartwatch—another way to personalize and stay connected… most importantly, stay competitive.

The PUMA smartwatch will be shown at IFA in the Fossil Group booth, Messe Berlin Messedamm 22 Hall 4.2. Booth 221. The smartwatch will be available for $275 in November on puma.com and select retailers. For more information, visit http://www.PUMA.com/Smartwatch.

PUMA SMARTWATCH FEATURES INCLUDE:

Heart Rate Tracking

Keep an eye on your heart rate, whenever you move, wherever you sweat with Google Fit.

GPS Tracking

Wherever you go. Phone Free, built-in GPS keeps you on track.

The Google Assistant

Get more done with your voice. Ask your Google Assistant questions, give commands, set reminders, and

more.

Music

Keep the vibes going, connect and listen to Spotify.

Google Pay

NFC payments with Google Pay allow the users to make in-store purchases using their smartwatch. *Google Pay available in select countries

Weather

Rain for shine. In real-time. Weather updates as you need them.

Training Apps

For when you need to sweat. Easily sync your workouts to compatible training apps.

Swimproof

Swimming, no problem. Jump right in.

Additional features include:

Smartphone Notifications

Activity Tracking

Rapid Charging

|

Répondre

|

Suivez les marchés avec des outils de pros !

Suivez les marchés avec des outils de pros !