La distribution des actions par Kering est effective - Page 3

Cours temps réel: 15,57 0,39%| Cours | Graphes | News | Analyses et conseils | Historiques | Vie du titre | Forum |

Puma : le titre grimpe, Morgan Stanley plus optimiste

06/08/2019

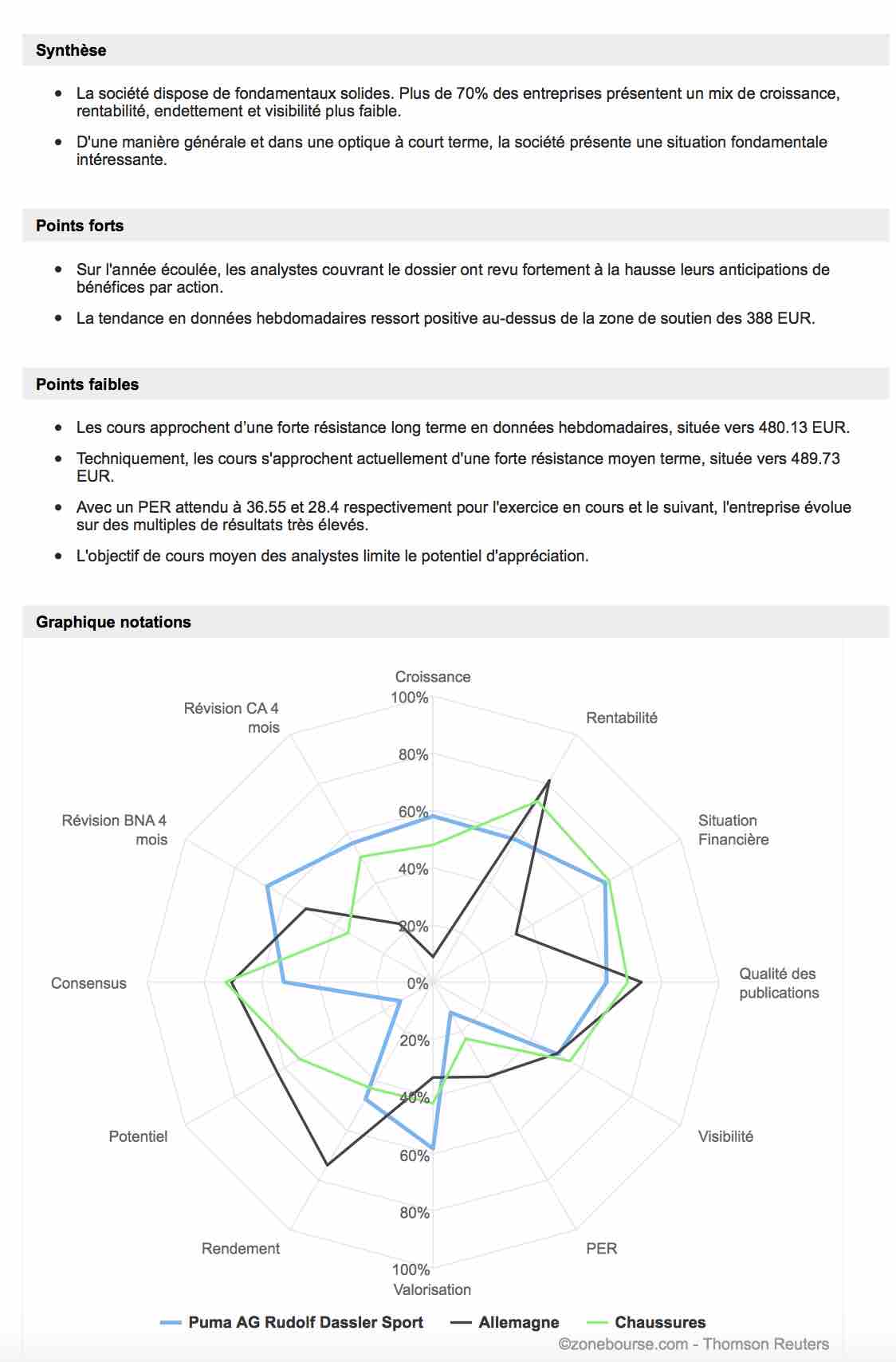

L'action Puma signe la deuxième plus forte hausse de l'indice MDAX mardi matin suite à un relèvement de recommandation de Morgan Stanley, qui met notamment en avant les solides perspectives du groupe.

Vers 10h45, le titre grimpe de 3,2% à 62,5 euros quand l'indice allemand des capitalisation moyennes ne prend que 0,2%.

Dans une note consacrée aux équipementiers sportifs, Morgan Stanley souligne la dynamique favorable du secteur, sous l'impulsion notamment de la vigueur du marché américain et de l'accélération du modèle de vente directe aux consommateurs ('direct to consumer').

Le bureau d'études affiche néanmoins une préférence particulière pour Puma en raison d'un niveau de valorisation similaire à celui d'adidas, pour des perspectives de croissance jugées bien plus solides.

Morgan Stanley relève ainsi son conseil sur la valeur de 'pondérer en ligne' à 'surpondérer' et porte son objectif de cours de 59 à 72 euros.

|

Répondre

|

PUMA : Credit Suisse relève sa recommandation

05/08/2019

Credit Suisse est passé de Sous-performance à Neutre sur Puma et a relevé son objectif de cours de 52 à 62 euros. Le groupe allemand de vêtements de sports a relevé mercredi dernier ses prévisions de ventes et de bénéfice annuels après un solide deuxième trimestre.

|

Répondre

|

Calendrier partiel PUMA 2019 :

• 31-JUL-2019 / RESULTS SECOND QUARTER 2019

• 24-OCT-2019 / RESULTS THIRD QUARTER 2019

|

Répondre

|

En grande forme depuis le split par 10.

Voici un nouveau graphe qui montre que la split a validé la sortie du cartouche de latéralisation violet. Le titre toujours très recherché comme le montre les indicateurs graphiques MACD et RSI.

La MM 20 rouge est revenu prendre appui sur la MM 60 orange pour continuer de s'envoler...

La tendance reste positive : DM+ dominante haussière et DM- rouge cantonné au niveau bas.

.

|

Répondre

|

La hausse devrait continuer !...

Puma : Les analystes restent positif sur le titre.

Actualité | 02.07.2019

-----------------------------------------------------

• Société Générale (de 62.70 à 63 EUR),

• JPMorgan (59 EUR),

• HSBC (de 62.50 à 72 EUR)

• Macquarie (68 EUR)

Ceux qui ont vendu à la distribution "Kering" doivent s'en mordre les doigts vu la hausse affiché depuis le détachement...

|

Répondre

|

PUMA : SPLIT: 10 pour 1, c'est effectif depuis hier !

PUMA SE PLANS SHARE SPLIT AT A RATIO OF 1:10

https://about.puma.com/en/newsroom/corporate-news/2019/2019-03-04-puma-plans-share-split

---------------------------------------------------------------------------------------------------------------

PUMA SE plans share split at a ratio of 1:10 after preceding increase of the share capital from company funds

The Supervisory Board and the Management Board of PUMA SE decided today to propose to the General Meeting on 18 April 2019 the resolution on a capital increase from company funds by EUR 112,213,532.16 to EUR 150,824,640.00 without the issuance of new shares (section 207(2)(2) Stock Corporation Act) as well as a subsequent amendment of the Articles of Association to re-divide the share capital at a ratio of 1 to 10 (share split).

Neither the capital increase from company funds nor the share split will result in any changes in the ownership structure of the shareholders in the Company. If the proposed resolutions are accepted by the General Meeting and the amendments to the Articles of Association is registered in the commercial register, each existing share will automatically be exchanged for 10 new shares. As a result of the increase in the number of shares of the Company by a factor of 10, their stock market price is expected to decrease accordingly.

The agenda of the General Meeting 2019 including the resolution proposals of the Management Board and the Supervisory Board is expected to be published in the Federal Gazette on 11. March 2019.

|

Répondre

|

Puma : Goldman Sachs reste à l'achat avec un objectif de cours relevé de 606 à 665 EUR.

Message complété le 23/05/2019 11:16:38 par son auteur.

Heureusement qu'il fallait les vendre au moment de cession par Kering.

Ceux qui ont osé gardé font actuellement une très belle plus value...

|

Répondre

|

Publié ce jour....

Puma : Berenberg reste à l'achat avec un objectif de cours relevé de 535 à 580 EUR.

|

Répondre

|

Puma: UBS reste à 'achat', réduit sa cible

Actualité publiée le 15/02/19 11:14

UBS réaffirme sa recommandation 'achat' sur Puma tout en abaissant son objectif de cours de 540 à 520 euros, au lendemain de la publication par le fournisseur allemand d'articles de sport de ses résultats 2018.

Dans sa note de recherche, le broker justifie sa position positive en expliquant qu'il voit, au-delà des objectifs jugés 'conservateurs' pour l'exercice 2019, une dynamique de croissance des ventes solide qu'il évalue à 12%.

L'intermédiaire financier a néanmoins abaissé son estimation de profit opérationnel pour 2019 à 424 millions d'euros, le conduisant à réduire sa cible sur le titre à 520 euros, ce qui implique un potentiel de hausse de 15%.

Message complété le 15/02/2019 11:45:38 par son auteur.

++++++++++++++++++++++++++++++++++++++++++++++++

Puma: consensus de BPA manqué en 2018

Actualité publiée le 14/02/19 14:15

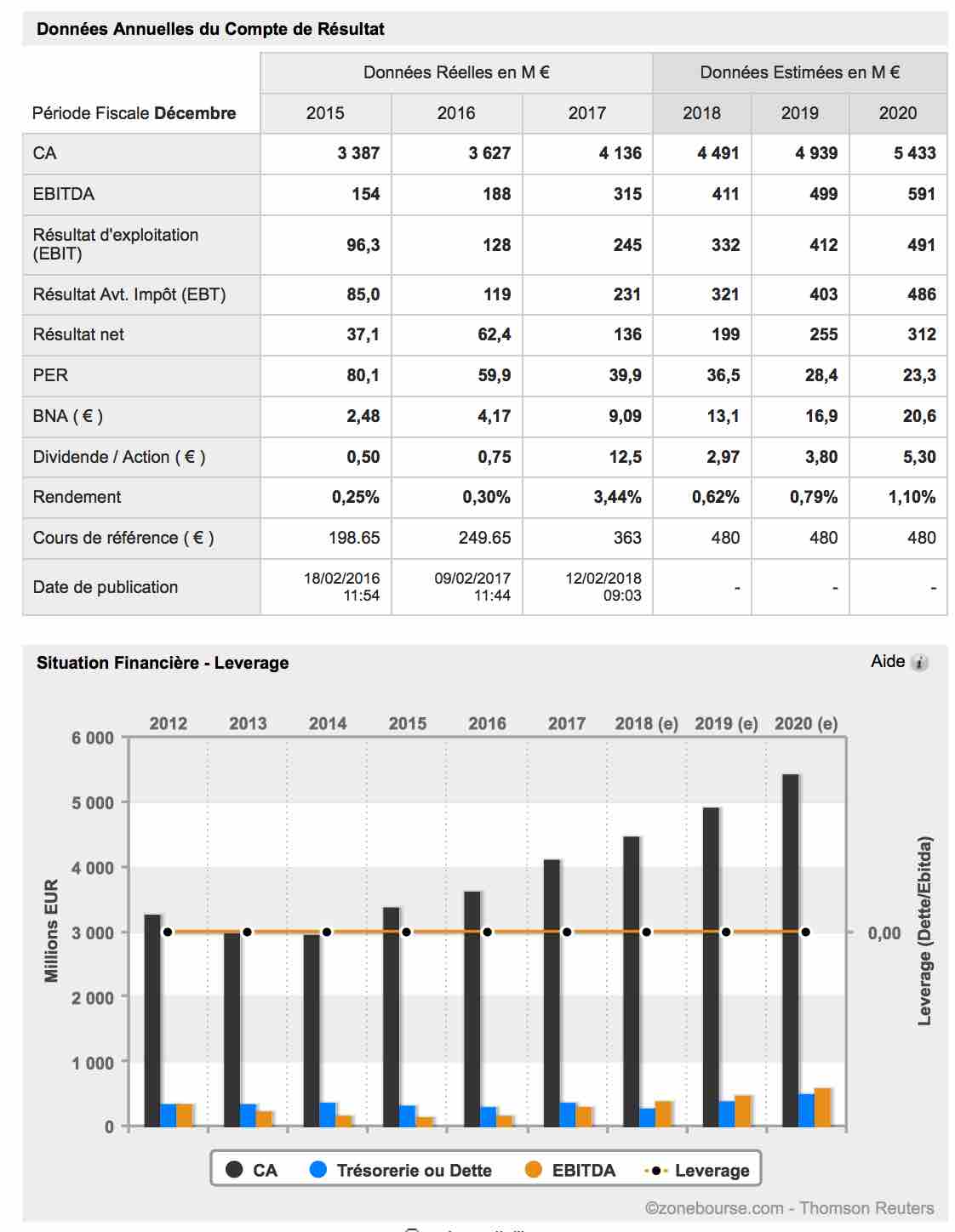

Puma lâche 5,7% à Francfort, après la présentation par l'équipementier sportif d'un bénéfice net annuel en hausse de 38% à 187,4 millions d'euros, soit 12,54 euros par action, un BPA inférieur au consensus qui était plus proche de 12,90 euros.

Le groupe allemand a amélioré sa marge brute de 110 points de base à 48,4%, pour un chiffre d'affaires en croissance de 12,4% à 4,65 milliards d'euros (+17,6% hors effets de changes), avec des croissances à deux chiffres dans toutes les régions et segments.

La direction de Puma proposera un dividende de 3,50 euros par action au titre de l'exercice écoulé. Pour 2019, elle prévoit une croissance des revenus hors effets de changes de l'ordre de 10% et un profit opérationnel entre 395 et 415 millions d'euros.

|

Répondre

|

L'année 2018 de PUMA !

2018 FOURTH QUARTER FACTS

• Sales increase by 20.1% currency adjusted to € 1,226 million (+17.9% reported) with strong growth in all regions and product segments

• Gross profit margin remains stable at a high level of 47.1%

• Operating expenses (OPEX) increase by 17.1% due to higher sales related variable costs as well as higher marketing and retail investments

• Operating result (EBIT) improves from € 30 million last year to € 38 million

• Strong sell-through of newly launched footwear franchises RS-X and Cali

• PUMA sponsored team Denmark wins Handball World Cup

2018 FULL-YEAR FACTS

• Full-year sales increase by 17.6% currency adjusted to € 4,648 million (+12.4% reported) with double-digit growth in all regions and product segments

• Gross profit margin improves by 110 basis points to 48.4%, supported by higher margins in all product segments

• Increase in operating expenses of 11.8% provides slight operating leverage

• Operating result (EBIT) improves strongly by 37.9% from € 245 million to € 337 million

• Net earnings and earnings per share increase by 38.0% from € 135.8 million to € 187.4 million and from € 9.09 to € 12.54 respectively

• Free Cashflow improves from € 128 million to € 173 million

• A dividend of € 3.50 per share for 2018 to be proposed at the Annual General Meeting

• PUMA share returns to M-DAX in June 2018

• Strong new styles Thunder, RS-0 and RS-X established in the “chunky shoe” category

• PUMA re-enters basketball category after 20 years

• PUMA signs supermodel Adriana Lima as women’s training ambassador

++++++++++++++++++++++++++++++++++++++++++++++++++++

BJØRN GULDEN, CHIEF EXECUTIVE OFFICER OF PUMA SE :

“We are very happy with how our business developed in 2018. Sales rose organically by 17.6% to €4,648 million and the operating result (Ebit) improved by 37.9% % to €337 million, which shows our strong momentum.

The double-digit growth in all regions is a proof that the we have strenghtened the PUMA brand globally and the double-digit growth in all product divisions shows that we have enhanced our product portfolio.

We still have a lot to improve, but we feel we are moving our brand and company in a good direction. We see that our progress will also continue in 2019 and expect our currency adjusted sales to grow around 10% and our operating result to increase to a range between €395 million and €415 million.”

|

Répondre

|

Agenda 2019 complété de Puma :

• 14-FEB-2019 . FULL-YEAR FINANCIAL RESULTS 2018

> Press Conference in Herzogenaurach - Analyst Conference Call

• 18-APR-2019 : ANNUAL GENERAL MEETING (Herzogenaurach)

• 25-APR-2019 : DIVIDEND PAYMENT

• 26-APR-2019 : RESULTS FIRST QUARTER 2019

• 31-JUL-2019 : RESULTS SECOND QUARTER 2019

• 24-OCT-2019 : RESULTS THIRD QUARTER 2019

|

Répondre

|

Nette hausse motivé par un ETE de retournement haussier : retour sur 505,70 en vue...

J'avais dans mon graphe non publié ajouté un cartouche de consolidation latéral de sommet en violet et esquissé l'hypothèse d'un repli sur le pied de cartouche. Mais je n'avais pas envisagé que l'on progresse sous le cartouche pour réaliser un bel ETe inversé et donc de retournement haussier (3 cercles rouges).

On a certes enfoncé le support de hausse, mais par contre on rebondit dans le cartouche de manière rapide après avoir de plus fait une pose de consolidation sur l'oblique de résistance en pointillé rouge.

En prime la MM 20 rouge est phase de reprise haussière et embrôchent des 3 autres MM 60,100 et 200 à la hausse. le passage de la MM 20 au dessus de la résistance haussière en pointillés rouge vers 454 devrait soutenir la hausse actuelle.

La publication annuelle devrait encore prendre le relais pour maintenir les cours à des niveaux élevés...

Agenda à venir sur PUMA :

• 14/02/19 Année 2018 Publication de résultats

• 26/04/19 Q1 2019 Publication de résultats

• 31/07/19 Premier semestre 2019 Publication de résultats

• 24/10/19 Q3 2019 Publication de résultats

.

.

|

Répondre

|

Reçu ce matin, ça n'a pas grand intérêt, surtout que l'accompte d'impôt a déjà été prélevé dessous et que l'on prévoit un cours plus élevé....

+++++++++++++++++++++++++++++++++AVIS D'OPERATION SUR TITRES

Date : 06/06/2018

Objet: OFFRE DE CESSION DE0006969603 - PUMA

Nous vous informons que suite à la distribution du dividende exceptionnelde la société KERING en titres PUMA, la société KERING a décidé de proposer aux actionnaires français une cession volontaire en Bourse de FRANCFORT des actions PUMA, selon les modalités ci-après :

• Prix de cession : cours en vigueur lors de la vente globale des actions en Bourse de FRANCFORT. Le produit de cette vente sera réparti aux ayants droits au prorata desactions cédées par chacun d'eux.

• Date de vente en Bourse de FRANCFORT : à partir du 25.06.2018

• Durée de l'offre de cession : du 06.06.2018 au 20.06.2018

NB :

1) Facteurs de risque : Il est rappelé que la participation à la procédure de cession mentionnée ci-dessus est facultative et que son but principal est de permettre la cession des actions PUMA sur le marché réglementé de Francfort. Aucune garantie n'est donnée sur le prix auquel les actions PUMA seront cédées. Il existe un risque que les conditions de marché prévalant au moment où l'agent centralisateur fera procéder à la cession des actions PUMA soient moins favorables que les conditions de marché qui prévalaient au moment où les titulaires d'actions PUMA ont décidé de participer à la procédure facultative de cession.

2) Les titres non présentés à l'offre de cession volontaire devront être transférés chez notre correspondant en ALLEMAGNE, au titre d'actions de sociétés étrangères et soumis aux frais afférents à cette place.

Les montants reçus dans le cadre de cette offre entrent dans le calcul annuel des cessions.Sous réserve du dénouement des éventuelles opérations en cours, vous déteniez au 05.06.2018 : "X" action(s) PUMA.

Si vous êtes abonné au site de Bourse en ligne et que vous souhaitez présenter des actions à la cession volontaire, vous avez la possibilité de saisir votre réponse directement en interrogeant votre portefeuille et en cliquant sur le bouton « OST en cours ».

Dans le cas contraire, vous pouvez nous faire parvenir votre mandat-réponse à l'adresse indiquée sur ce dernier au plus tard le 19.06.2018. Nous restons à votre disposition pour tout renseignement complémentaire.

Votre chargé de clientèle

|

Répondre

|

Consolidation en base élevée en cours...

.

|

Répondre

|

ça confirme ce que je vous disais précédemment...

Puma: UBS entame le suivi à l'achat et vise 550 euros

Actualité publiée le 30/05/18

UBS a entamé le suivi de Puma avec un premier conseil d'achat sur le titre de l'équipementier sportif allemand, distingué pour sa croissance. L'objectif de cours à 12 mois associé est fixé à 550 euros, augurant d'un potentiel de hausse de 12,5%.

Voilà environ deux semaines que le flottant de Puma a bondi d'environ 14 à 55%, après le spin-off réalisé par Kering. UBS se penche donc sur le 4e équipementier sportif mondial. 'Nous estimons que le potentiel de Puma est sous-évalué', indique une note qui met en avant le retournement opéré par le groupe, les innovations qu'il a en réserve, et 'des dynamiques de marché favorables'. Selon les analystes, Puma est bien parti pour accroître son CA de 12% l'an environ d'ici 2020, ce qui serait accompagné d'un levier sur les marges et d'une augmentation du bénéfice par action de 35%.

UBS relève par ailleurs que l'action Puma présente pour l'heure une décote de l'ordre de 15% sur Adidas, en utilisant le ratio valeur d'entreprise / ventes

|

Répondre

|

Clôture à 498.25EUR = +3.80%

Alors que la valeur comptable retenue pour le détachement en action par Kering était de 412,50.

La plus value atteint en quelques jours : +20,78%

Message complété le 21/05/2018 19:45:01 par son auteur.

NB : La cote donnée par ABC Bourse est différé de 24 heures (ou dernière séance pour les WE...)

Message complété le 21/05/2018 19:51:06 par son auteur.

Manifestement, il se pourrait que certains cherchent à prendre une participation significative du groupe pour en prendre le contrôle après Kering...

ça pourrait continuer de monter dans ce cas si l'hypothèse se vérifiait.

Le nombre d'actions total est faible pour une société de cette envergure : 15 082 464 titres.

Une action Puma représente 297,76 euros du CA prévisionnel 2018...

|

Répondre

|

.

|

Répondre

|

.

|

Répondre

|

16/05/2018 | 11:04

A la suite de l'approbation de l'opération par les actionnaires de Kering lors de l'assemblée générale du Groupe le 26 avril 2018, la distribution des actions Puma aux actionnaires de Kering est effective à compter de ce jour, date de mise en paiement du dividende en nature. La distribution des actions Puma aux actionnaires de Kering est effectuée selon une parité d'une action Puma pour douze actions Kering, conformément aux modalités de l'opération annoncées par Kering le 13 février 2018.

Le cours d'ouverture de l'action Puma qui servira notamment de référence au calcul de la fiscalité était de 429 euros ce matin 16 mai 2018 sur la plateforme de négociation Xetra à Francfort.

Comme annoncé précédemment, Kering conservera à l'issue de cette opération 15,70% du capital social et 15,85% des actions en circulation et des droits de vote de Puma. A compter de ce jour, cette participation sera comptabilisée par mise en équivalence dans les états financiers de Kering.

|

Répondre

|

Et on sort à la hausse du canal haussier vert ...

La cote est décalé d'un jour (Marché allemand) : ce matin, on poursuit encore, on s'envole actuellement à 492.5 EUR

.

|

Répondre

|

Suivez les marchés avec des outils de pros !

Suivez les marchés avec des outils de pros !